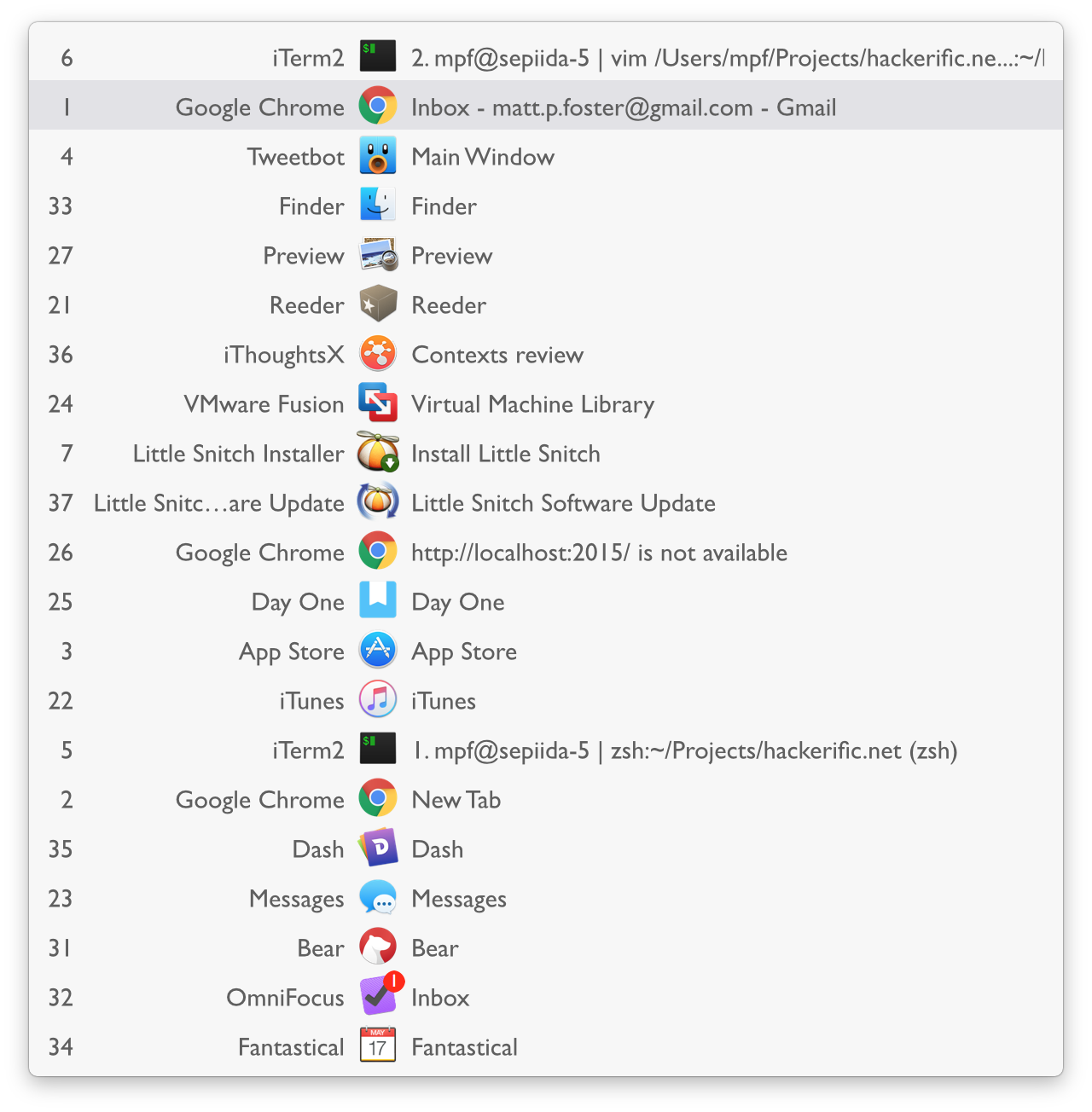

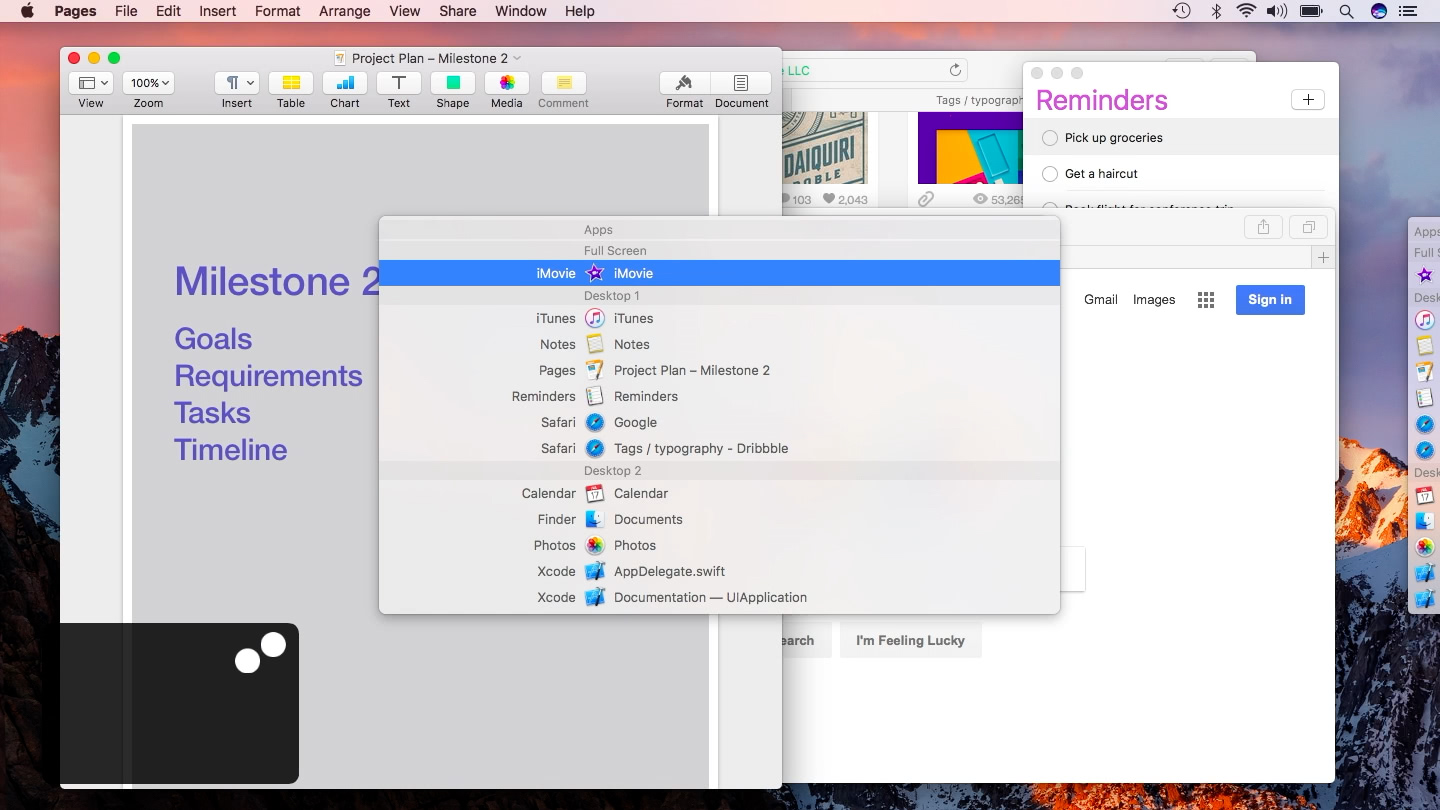

Context switching of threads. Context switching is switching of the central processing unit from one process or thread to another. A process (also sometimes referred to as a task) is an executing (i.e., running) instance of a program. In Linux, threads are lightweight processes that can run in parallel and share an address space and other. Contexts 2.7 Fast window switcher. Contexts is a radically faster and simpler window switcher. It gives you 4 ways to switch windows: Switch with one click to any window: An auto-hiding sidebar shows your windows organized in groups. To switch to a window just click its title in the list. It is as simple as that.

Customizing Apache for Windows

Apache is configured by the files in the conf subdirectory. These are the same files used to configure the Unix version, but there are a few different directives for Apache on Windows. See the directive index for all the available directives.

The main differences in Apache for Windows are:

Because Apache for Windows is multithreaded, it does not use a separate process for each request, as Apache can on Unix. Instead there are usually only two Apache processes running: a parent process, and a child which handles the requests. Within the child process each request is handled by a separate thread.

The process management directives are also different:

MaxConnectionsPerChild: Like the Unix directive, this controls how many connections a single child process will serve before exiting. However, unlike on Unix, a replacement process is not instantly available. Use the defaultMaxConnectionsPerChild 0, unless instructed to change the behavior to overcome a memory leak in third party modules or in-process applications.Warning: The server configuration file is reread when a new child process is started. If you have modifiedhttpd.conf, the new child may not start or you may receive unexpected results.ThreadsPerChild: This directive is new. It tells the server how many threads it should use. This is the maximum number of connections the server can handle at once, so be sure to set this number high enough for your site if you get a lot of hits. The recommended default isThreadsPerChild 150, but this must be adjusted to reflect the greatest anticipated number of simultaneous connections to accept.The directives that accept filenames as arguments must use Windows filenames instead of Unix ones. However, because Apache may interpret backslashes as an 'escape character' sequence, you should consistently use forward slashes in path names, not backslashes.

While filenames are generally case-insensitive on Windows, URLs are still treated internally as case-sensitive before they are mapped to the filesystem. For example, the

,Alias, andProxyPassdirectives all use case-sensitive arguments. For this reason, it is particularly important to use thedirective when attempting to limit access to content in the filesystem, since this directive applies to any content in a directory, regardless of how it is accessed. If you wish to assure that only lowercase is used in URLs, you can use something like:When running, Apache needs write access only to the logs directory and any configured cache directory tree. Due to the issue of case insensitive and short 8.3 format names, Apache must validate all path names given. This means that each directory which Apache evaluates, from the drive root up to the directory leaf, must have read, list and traverse directory permissions. If Apache2.4 is installed at C:Program Files, then the root directory, Program Files and Apache2.4 must all be visible to Apache.

Apache for Windows contains the ability to load modules at runtime, without recompiling the server. If Apache is compiled normally, it will install a number of optional modules in the

Apache2.4modulesdirectory. To activate these or other modules, theLoadModuledirective must be used. For example, to activate the status module, use the following (in addition to the status-activating directives inaccess.conf):Information on creating loadable modules is also available.

Apache can also load ISAPI (Internet Server Application Programming Interface) extensions such as those used by Microsoft IIS and other Windows servers. More information is available. Note that Apache cannot load ISAPI Filters, and ISAPI Handlers with some Microsoft feature extensions will not work.

When running CGI scripts, the method Apache uses to find the interpreter for the script is configurable using the

ScriptInterpreterSourcedirective.Since it is often difficult to manage files with names like

.htaccessin Windows, you may find it useful to change the name of this per-directory configuration file using theAccessFilenamedirective.Any errors during Apache startup are logged into the Windows event log when running on Windows NT. This mechanism acts as a backup for those situations where Apache is not yet prepared to use the

error.logfile. You can review the Windows Application Event Log by using the Event Viewer, e.g. Start - Settings - Control Panel - Administrative Tools - Event Viewer.

Meer samenvattingen voor MNE2601 bekijken? Bekijk al het beschikbare studiemateriaal op de MNE2601 overzichtspagina

Samenvatting

MNE2601 BEST SUMMARY NOTES. MNE2601 - Introduction To Entrepreneurship And Small Business Management. The Economic impetus of Entrepreneurship Economic development can be directly attributed to the level of entrepreneurial activity in a country. A combination of all types of businesses from Small, Medium, and Micro enterprises (SMME's), to large National and International organisations (Private and Public owned) collectively determines the overall state of the economy. GDP – real Gross Domestic Product – is the value of all production within a country's geographical boundaries, and it is used to measure the growth (or decline) activity within our economy. Employment is also closely linked to the state of the economy. During periods of poor economic growth, less job opportunities are available. The importance of entrepreneurs is crucial for the improvement of the South African economy and is also regarded as the best opportunity that exists. The Development of Entrepreneurship Theory (entreprenology) Can be divided into five periods according to Fillion (1991). Period Topic Authors & researchers What entrepreneurs do 1950 Economic perspective Cantillon, Say, Schumpter Who entrepreneurs are 1960 - 1980 Behavioural perspective Weber, McClelland, Rotter, De Vries What entrepreneurs do 1980 - 1985 Management science perspective Drucker, Mintzberg What support is needed by entrepreneurs 1985 - 1990 Social perspective (economists, geographers and sociologists) Gartner, Welsh, Bygrave, Reynold What entrepreneurial activities are 1990 - Entrepreneurial perspective (finance, marketing, operations, human resources) Timmons, Vesper, Brockhaus Defining Entrepreneurship, Small business and Entrepreneurial ventures Entrepreneur and Entrepreneurship Entrepreneurship: is the emergence and growth of new business. The motivation for entrepreneurship is to make a profit. Entrepreneurship involves the process that causes changes in the economic system through innovations of individuals who respond to opportunities in the market. In the process entrepreneurs create value for themselves and society. Carland, Hoy, Boulton & Carland: An entrepreneur is an individual who establishes and manages a business for the main purposes of profit and growth. Watson: The distinguishing factors of entrepreneurs are mostly innovation, opportunity recognition and growth in a business Entrepreneur: an entrepreneur is a person who sees an opportunity in the market, gathers resources and creates and grows a business venture to meet these needs. The entrepreneur bears the risk of the venture and is rewarded with profit if it succeeds. The key concepts of an entrepreneur that follow the definitions above are: • Identifying an opportunity: A real business opportunity must exist • Innovation and creativity: Some new and different is required • Getting resources: Capital labour and operating equipment must be found • Creating and growing a venture: Starting of a new business venture or the conversion of an existing business • Taking risks: Personal and financial risks are involved for the one who takes on the entrepreneurial process. • Being rewarded: It can be in the form of profit or an increase in the value of the business. Small business Watson: Small business owners are individuals who establish and manage their businesses for the principal purpose of furthering personal goals and ensuring security. The activities of artisans/craftsmen, administration/manager and security/family are indicated as characteristics of small business ownership. Carland: Therefore, a small business is any business that is independently owned and operated, but is not dominant in its field and does not engage in any new marketing practices. Qualitative criteria ..which relate to the ownership structure of the business, specifies that it must: • Be a separate business entity • Not be part of a group of companies • Include any subsidiaries and branches when measuring the size • Be managed by its owners • Be a natural person, sole proprietorship, partnership or a legal person, such as a close corporation or company. Quantitative criteria ..quantitative criteria classify businesses into micro, very small, small and medium, using these guidelines: • Total full-time paid employees • Total annual turnover • Total gross asset value (excluding fixed property) Entrepreneurial Ventures Entrepreneurial ventures: main objectives are profitability and growth. Three characteristics distinguish the entrepreneurial venture from small business (Wickham); Innovation: Entrepreneurial ventures thrive on innovation. Small business is usually only involved in delivering an established product or service. Potential for growth: Due to its innovative approach, an entrepreneurial venture has a great deal more potential for growth than a small business. The small business operates in an established industry and is unique only in terms of its locality. Strategic Objectives: The entrepreneurial venture will usually set itself strategic objectives in relation to: Market targets, Market development, Market share, Market position Entrepreneurial ventures are the ones that create employment. Both ventures require entrepreneurial action for start-up, but the small business will tend to stabilise at an early stage and only grow with inflation. Entrepreneurial Development Factors that influence the entry of entrepreneurs are: • Entrepreneurial orientation: Family and roles models Education Culture Work experience Personal orientation (creativity and innovation, autonomy, risk taking, proactiveness, competitive) • A supportive environment: Financing Training and development • A cooperative environment Universities and other educational institutes The fundamental infrastructure requirements such as roads, electricity, water and communications are vital factors in entrepreneurial development. The domains of Entrepreneurship, Management and Leadership Not all entrepreneurs are good managers or leaders, but certain management and leadership skills are critical for entrepreneurial success. Once established, the role of the entrepreneur then changes to that of a manager, including planning, organising, leadership and control. The various business functions also have to be managed: marketing, purchasing, production, human resources, administration, public relations and finance. Success factors of Entrepreneurs Entrepreneurial Factors Managerial Factors Creativity and Innovation Planning – systematic approach Risk orientation Knowledge of competition Leadership Mainly market orientated Good human relations Client service Positive attitude High-quality work Perseverance Financial insight and management Commitment Business knowledge and skills Use of experts The Entrepreneurial process There are 4 distinct phases: 1) Identifying and evaluating the opportunity: An opportunity is a gap in the market which is not currently served. A good opportunity is attractive, durable and timely. It creates or adds value to the market which it serves. Identifying and evaluating an opportunity is difficult as an entrepreneur must deliberately formulate ideas which can be converted into a business opportunity. A number of techniques can be used: The entrepreneur's skills, expertise or aptitude, Common needs, existing unsolved problems, Everyday activities In order to convert ideas into opportunities, each short-listed idea requires a feasibility and viability study. A feasibility study: is a general examination of the potential of an idea to be converted into a new business venture, with its primary focus on the ability of the entrepreneur to pursue the idea and match his skills with what is required. A viability study: is an in-depth investigation into the potential of the idea to be converted into a new business venture. 2) Developing the business plan: A good and detailed business plan must be developed in order to exploit the opportunity identified. The business plan is important in developing the opportunity as well as determining the resources required, how they will be obtained and how to manage the resulting business venture successfully. By compiling a business plan, the entrepreneur is ‘forced' into thinking about the various aspects of the enterprise resulting in an information gathering and self-examination process. A diligently prepared business plan therefore helps reduce the risk of the venture. 3) Determining the resources required: Resources consist of the following: • Financial resources – Capital for investing in the venture which can take the form of cash, credit or loans • Human resources – People (employees) • Physical resources – Assets such as equipment, machinery, buildings and vehicles etc.. When determining the resources required, the process would start with evaluating one's own resources and how much investment or loans will be needed to start operating. Resources cannot be determined without a cash flow projection, which is done simultaneously with the development of the business plan. 4) Starting and managing the enterprise: Once the minimum start-up capital has been acquired, the entrepreneur must put it to use by implementing the business plan. Initially the business may be relatively small employing (if any) only one or two employees. Once the business starts to grow it becomes important to determine the variables required for success. STUDY UNIT 2 Chapter 2: The Entrepreneur The entrepreneur as a catalyst for economic activity Entrepreneurship is a key driver within an economy, which is highly valued and a key contributor to economic and social growth. Entrepreneurs in South Africa are seen as the primary creators and drivers of new businesses. Entrepreneurs play a vital role in the survival and growth of any emerging economy, and thus provide a critical solution to slow economic growth, low employment rates and unsatisfactory levels of poverty. Entrepreneurs at various levels of entrepreneurial sophistication 1) Basic survivalists: No economic independence, little involvement with other entrepreneurs (individualism) EA: Isolated from markets, unaware of their own potential, illiterate, few income-generating activities. Eg: someone standing on the street, holding signboard advertising 'Car Wash: R10' 2) Pre – entrepreneurs: Follow the group's initiative (collectivism) EA: Welfare-orientated approach, not expected to be self-sustaining and requiring training. Eg: Person selling items at robots with ten others selling exactly the same products at exactly the same prices. 3) Subsistence entrepreneurs: Self-employed, independent income generation EA: Inexperienced in business management and needs training in technical & management skills. Eg: street vendors. 4) Micro entrepreneurs: Zero to nine employees, operating from a fixed workshop with an operating license EA: Difficulty in getting loans from banks, Focus on credit rather than training and technical assistance. Eg: Entrepreneur who runs a home-based business such as a hairdressing salon. 5) Small – scale entrepreneurs: Ten to 49 employees EA: Qualifies for a loan from a bank. Well – educated and has adequate collateral to apply for a loan. Eg: Small accounting or law firm. The background and characteristics of entrepreneurs The background of entrepreneurs • Childhood family environment: It is often found that entrepreneurs have at least one parent who was (or still is) an entrepreneur. Entrepreneurship is best learnt through experience to through contact with family members who are entrepreneurs. • Education: Education is seen as one of the most significant barriers to entrepreneurial activity. Higher levels of education are associated with levels of entrepreneurial activity. • Personal values: Research indicates that certain values nourish entrepreneurship. These include individuality, leadership qualities, ambition, opportunity focus, honesty and ethical behaviour. • Age: Most of these entrepreneurs would have worked for some organisation before embarking on their own venture. 25 to 34 years of age - an indication that nowadays people start businesses from a very young age. • Work experience: Entrepreneurs who are most likely to succeed are those who have gone on to do training after school and have work experience. They have seen entrepreneurial opportunities from an employment base. The characteristics of entrepreneurs ○ Passion: It is preferable that they pursue business activities for which they have a passion – if they find it interesting and fascinating, there is a much higher likelihood of success. ○ Locus of control: Entrepreneurs are typically keen to be in control and have good delegation skills. They have a high degree of autonomy and do not want to be told what to do. ○ Need for independence: Related to the desire for control is the need for independence. Many entrepreneurs leave their employer to start their own venture. ○ Need for achievement: The need for achievement is closely linked to the entrepreneurial motivation to excel. McCelland states that entrepreneurs have a great need for achievement when compared with other individuals. ○ Risk taking and uncertainty: Risk taking involves more than just the risk of losing financial resources should the venture fail it can also include social and personal risks. ○ Creativity and innovation: Creativity and innovation are sources of creating a competitive advantage. They are seen as the key ingredient to establish a niche market and to determine an organisations competitive edge. ○ Determination and persistence: In an ever changing economic, social, political and technical environment it is necessary to maintain focus, determination and persistence. Role models and support systems Types of network systems: Social networks: Communication / exchange of information (exchange business cards at a social (golf course)) Personal networks: Entrepreneur has day-to-day direct contact (customers) Extended networks: Focused on a network of organisations rather than an individual. Other networks: The internet, Suppliers, Investors, Bankers, Lawyers, etc. Push and Pull factors Botha distinguishes between push and pull factors: Entrepreneurs who take advantage of business opportunities are normally pulled towards entrepreneurship. These entrepreneur types are known as opportunity entrepreneurs. People who start businesses as a result of not having any other employment options are usually pushed towards entrepreneurship. These entrepreneur types are known as necessity entrepreneurs. Push factors: encourage entrepreneurship when there are no other alternatives: • Unemployment • Job insecurity as in the case of a person working on a contract basis. • Disagreement with management, career limitations and setbacks in a conventional job. • Not fitting in with the organisation, or the inability to pursue personal innovation in a conventional job. • The limitations of financial rewards from conventional jobs. • Having no other alternatives. Pull factors: encourage people to leave their conventional jobs to become an entrepreneur: • Independence: the freedom to work for one-self • Achievement: a sense of acknowledgement gained from managing one's own venture • Recognition: a desire to gain the social standing achievement by entrepreneurs • Personal development: the freedom to pursue personal innovation • Personal wealth: the financial rewards of entrepreneurship Challenges facing Entrepreneurs and SMME's in South Africa 1) Access to start-up and expansion finance: Raising money in capital markets, including for bank loans, is a minefield for start-ups, and often entrepreneurs launch their business using their own money (80%). Over the past few years the Government through the Department of Trade and Industry and Khula Enterprise Finance, has designed and implemented incentives, subsidies and schemes that have improved SMME's access to finance. However, a significant number of SMMEs' are still not able to access affordable start-up and expansion finance. The reasons for this lack of access to finance include: •Risk aversion of the banking sector towards SMME's. •There has been a decline in alternative financial institutions. •Inadequate funding proposals and business plans. The above challenges can be overcome by: • Business success: The business success and profitability of SMMEs need to be improved. A sound business understanding, experience and exposure to the business environment are critical. • Financial products: Financial institutions and MFIs should provide SMMEs with appropriate financial products and information on where and how to obtain finance should be made available. • Training: People who wish to become entrepreneurs need to be trained in researching on and presenting funding proposals, feasibility studies and business plans. • Financial guidance: Financial institutions must provide guidance and direction to SMMEs that have been denied finance, and give viable reasons why their loan requests were rejected. 2) Access to markets: SMMEs do not give enough priority to marketing in their overall business approach. Most do not segment their markets, analyse customer demand, and know competitors or trends. Many entrepreneurs especially previously disadvantaged tend to hope that success can be achieved by following what others are doing. The above constraints may be addressed by the following: •Marketing training: SMMEs need to be provided with effective marketing training. It is imperative to constantly upgrade marketing appeal and competencies. •Commitment to marketing: SMME entrepreneurs need to appreciate that to be successful, demonstrate an early awareness of and commitment to marketing. •Commitment to the market: SMMEs need to place the needs of the market at the forefront of their business concerns. This will lead to the necessary attitude and behaviour for developing superior value. •Market-orientated products: SMMEs should focus their efforts on supplying only those products and services which are demanded by the market. •Networking: Business Development Service agencies (BDS agencies) should assist SMMEs to gain access to markets by facilitating vertical and horizontal (networking) business linkages. 3) Access to appropriate technology: The use of appropriate technology is one of the most important factors behind a successful SMME's competitive advantage. Successful SMMEs constantly upgrade operational and production equipment and techniques. The use of up-to-date and new technology leads to: • Better and more competitive products and services • Improved efficiency • Reduce operational and production costs • Improved quality of products and services 4) Access to human resources: Human resources are widely acknowledged as being the ‘most precious asset' of a business. Issues involved in human resource management include addressing the skills, attitudes and expectations of employees and those of the entrepreneurs themselves. Entrepreneurs need to address the attitudes and expectations of their employees by: Building team spirit by doing team building exercises away from the work environment. Nurturing life-long learning in themselves and their employees Ensuring that their employees regard meeting customer needs as their responsibility Being role models for their employees Women and emerging Entrepreneurs Types of women business owners can be distinguished as follows: ○ Traditional: Traditional women business owners are highly committed to entrepreneurial ideas and conventional gender roles. They are motivated to start a business due to economic pressure at home. Primary focus - keep overheads, wages and costs low. ○ Innovative: Innovative women business owners are highly committed to entrepreneurial ideas but not traditional gender roles. They start their business because of limited career prospects in large organisations, they are ambitious and their business has high priority. ○ Domestic: Domestic women business owners are not committed to entrepreneurial ideas but have a high attachment to traditional gender roles (usually give up work for children). Most are run from home, with low-volume production & high quality. ○ Radical: Radical women business owners have little commitment to entrepreneurial ideas or to traditional gender roles. They are usually young, well-educated but have limited work experience. New labels for Entrepreneurs Emerging entrepreneurs: refers to previously disadvantaged groups Survivalist and micro entrepreneurs: Petty traders in the informal sector (such as shoeshine boys) Opportunity and necessity entrepreneurs: Motivational drivers been seen as choice (Pull factors – opportunity seekers) or necessity driven (Push factors) Youth entrepreneurs: Some schools provide students with entrepreneurship as a subject choice, Technology entrepreneurs: Entrepreneurs who take advantage of new scientific developments, especially in the areas of information technology, biotechnology and engineering science and offering their benefits to the world. Social entrepreneurs: Individuals with innovative solutions to society's most pressing social problems. Tourism entrepreneurs: This is the largest industry in the world and also the biggest employer. Many opportunities are available for entrepreneurs in the tourism industry, especially in South Africa. Entrepreneurs versus Inventor An inventor creates something new but lacks the skills to sell it. An entrepreneur will take over from the inventor and start a business venture in order to market the new invention. Male entrepreneurs vs Female entrepreneurs The comparaison: Men Women forge relatively weak ties forge relatively strong ties relatively hierarchical coalitions relatively democratic coalitions more short term orientated forge strong relationships with service providers support groups include friends, acquaintances and colleagues support groups include network groups or associations set the foundation of the business environment manufacturing and construction coffee shops & guest houses STUDY UNIT 3 Chapter 3: Creativity and Business opportunity The theory of creativity Creativity is a result of brain-driven actions which can transform various complex problems into attractive opportunities. The general definition includes the following: Creativity: the process of generating ideas that result in the improved efficiency or effectiveness of a system. The creativity model The 4P model of creativity serves as a basis for entrepreneurial creativity. The Person The most important variable in the creativity model is the entrepreneur. Creativity is a fundamental entrepreneurial skill, but it is also a learnable or acquired skill. To develop creativity in a person requires: 1) Expertise: which includes all the knowledge, experience and talent a person can use to apply in a certain situation. Expertise could be acquired through the persons' work experience, educational background, training interventions, and general daily social interactions with others, including family. 2) Motivation: The motivation component of creative people determines what they will do and whether they will do it. Creative people are not necessarily driven by their position or the level of work they do, as new ideas and their development are fuelled by a certain level of motivation. 3) Creative thinking skills: Creative thinking skills play an enormous role in the way a person will deal with a problem or idea. Creative thinking involves thought processes such as associating unrelated components and combining them into a new or unique way. Creativity myths: Creativity is an innate skill and cannot be acquired by means of training You need to be a rebel to be seen as creative Artists are the only creative beings You need to be ‘crazy' before creativity can kick in Up to an IQ level of 120 intelligence and creativity go hand in hand, after that, creativity decreases Some people are more creative in a group environment; others are just as creative when working alone. All new products were accidental discoveries Blocks to creativity: Environmental barriers: The Social environment creates certain barriers: • Risk taking is prohibited • Cultural barriers. The Economic environment may create barriers: • The economy in general is not conducive to the development of new ideas and products • There are no growth prospects in the economy The Physical environment could be a restrictive factor to creativity as follows: • Distractions, for example sounds, the climate and lack of energy • Conventional venues in the education and training environment Cultural barriers the following barriers are considered to be generic cultural barriers or mindsets: • You must go to school, then to university or college, and after that you will find a job • The unknown is unsafe • You must be practical and think economically before you generate ideas Perceptual barriers, these barriers refer to barriers in the way we see the world. • Using a narrow mind set when analysing problems. • Making assumptions about a problem or idea without considering all the information • Assuming that something will work, without doing proper research or feasibility studies The Process Creativity forms part of a continuous process and creative thinking is the fundamental basis of or facilitator in, the development of new initiatives, products or services. In the entrepreneurial context the creativity process should, in the end, always be linked to a feasible opportunity in the market environment. The process of creative problem-solving consists of consecutive steps as follows: 1. Idea Generation: The idea generation process is predominately a process of discovery. The process involves generating a multitude of ideas seeking to address a current problem or market opportunity (gap) emphasis is placed on quantity and not necessary quality. 2. Developing the most suitable or feasible idea: this is a process of invention, where the most suitable or feasible ideas are developed. 3. Transforming the most suitable idea into an innovation: Creativity is the thought process that leads to the generation of ideas to identify opportunities. Innovation is the practical implementation of the idea concept to ensure that the set aims are met on a commercial and profitable basis. Creative techniques • Random input: Random inputs are based on the development of words, pictures or images. • Problem reversal: Almost all ideas, arguments or attributes have an opposite. This is an exercise to see things backwards, inside out and upside down, thus enabling you to analyse the whole concept. View your problem in the reverse form. Change the negative form into the positive, and vv. Define what something 'is not', or the opposite thereof. Analyse what everybody else is not doing, or the opposite thereof. Use the 'what if' question. Change the direction of your perspective. Evaluate all results. Turn defeat into victory, and vv. • The 5 - W's & H technique: Embraces the questions 'Who', 'What', 'When', 'Where', 'Why' and 'How'. Apply all these questions to each of your ideas. • Association technique: Take a problem and make use of unrelated elements • Discontinuity principle: The more we get caught up in a routine, the less stimulating it. This method implies that we intervene in our daily routine by means of unusual interruptions, such as: Changing the route to work, home or to a friend Listening to a different radio station Reading material outside your frame of reference Talk to strangers Using a different approach during your lunch break, such as lying on your back outside on the grass • Other: brainstorming, surveys, focus groups and customer questionnaires Stages of the creative process Stage Requirement Awareness Recognition of a problem or situation Curiosity Preparation Openness to experience Analysis of how the task might be approached Intuitive ability Incubation Imagination Absorption Seeking ideas, possible answers and solutions Illumination (insight) Switch from intuitive to analytical thought patterns Eurika! Ah-Ha! Verification Critical attitude Analytical ability Testing Idea vs Opportunity An idea: a thought, impression or notion for a new product or service. An opportunity: is a favourable set of circumstances that creates a need for a new product, service or business. ↘Hisrich and Peters: as the process whereby the entrepreneur assesses whether a certain product, service or process will yield the necessary earnings based on the resource inputs that are required to manufacture and market it. There are two building blocks in the assessment of an opportunity: 1) The size of the market: Will the number of customers reward the input and energy required to create and deliver the product? 2) The time frame (window of opportunity) of the opportunity: Is the demand for the product or service based on a short fashionable phenomenon or is it based on a sustainable business and how long will it take before a competitor grabs the opportunity? The Product The new innovation or product is the direct result of the process. The ideas from the creative thinking process are then evaluated and the most suitable one is subjected to the product development process. New products results in changes such as: •Fundamental changes: Development of a cure for HIV/AIDS, or an efficient method to replace motor car fuel. •Incremental changes: Changes take place over time (updates of Microsoft Windows software and apps). Critical areas where innovations might be made: • New products: Today customers are flooded with new products on a daily basis (tangible products) • New services: The services industry in South Africa is growing at an immense rate. • New production techniques: Innovation is present in the way products are created or manufactured. • New operating practices: The economy is based on speed and innovation, and the way in which services are rendered, creates an array of opportunities for entrepreneurs. • New ways of delivering the product or service to the customer: Technology has changed the way in which various products are distributed to customers. • New ways of informing the customer about the product: Again the internet has led to comfort and the ability to access information about anything any time anywhere. • New ways of managing relationships within the organisation: Technological innovation has fundamentally changed the way employees communicate within the work environment. Legal protection of the product: In South Africa the following options are available to protect a new product or intellectual property: The following options are available to entrepreneurs who wish to protect their product: ○ Patents: A patent can cover any invention in the form of an apparatus, an article, a device, method or process. ○ Know-how: Secret technology which usually relates to processes can be licensed in return for payment. ○ Trademarks: Trademarks can be registered for name, logo and design and service protection. ○ Unlawful competition: This option can be used to protect an entrepreneur from other companies marketing products and services in such a manner that it creates confusion with the entrepreneurs business. ○ Copyright: This option can be used for the protection of intellectual content such as literary works. ○ Plants: Used for the protection of new varieties of plants. ○ Licenses: Licenses protect all forms of intellectual property. The following are not patentable: Mathematical methods, Aesthetic creations, Architectural designs, Schemes, Business methods, Rules for playing games, Computer programs, Scientific methods. STUDY UNIT 4 Chapter 4: The window of opportunity The opportunity An opportunity: is a gap left in the market by those who currently serve it (Niemann & Bennet) A good idea is not necessarily a viable and feasible opportunity. For an idea to be a lucrative one, besides being attractive, durable and timely, the resultant product or service must create and/or add value for the purchaser or end-user. Opportunity evaluation In order to determine whether or not a business idea will translate into a lucrative opportunity which poses the qualities of being timely, attractive, and durable, the entrepreneur needs to follow a strategy of evaluating or screening the opportunity. The evaluation and screening process helps the entrepreneur to clearly see whether the opportunity under review has a high or a low potential, and ultimately whether or not the opportunity is worth pursuing. The criteria used to screen opportunities can be summarised as follows: 1) Industry and market issues: Higher-potential ventures usually comprise of a niche market that caters for needs that certain customers deem to be important, and is therefore sustainable. The attractiveness is determined by the following factors: Market Structure: the number and size distribution of sellers in the market, the number and size distribution of buyers in the market, product differentiation, entry and exit conditions, number of buyers present, demand sensitivity to price changes. Market Size: A large and growing market is a lucrative market and well suit for an entrepreneur with a highpotential venture. A small stagnated market is not favourable for new entrants. Market Capacity: An attractive market is a market in which the current demand outweighs the current supply. Market Share: A firm that is unable to capture a substantial portion of the overall market share has lowgrowth potential, and thus not a favourable venture Cost Structure: In general, a firm that can provide low-cost goods and services whilst providing value for money is attractive. 2) Economics: Businesses that possess high and durable gross margins have high and durable profits. A venture that achieves a positive cash flow, quickly, is attractive. Where the time taken to reach a point of breakeven exceeds three years, the potential for the venture to be attractive is substantially reduced. 3) Harvest issues: An entrepreneur should always bear in mind that there is always a possibility that the venture will be sold. This is referred to as an exit strategy, and attractive ventures in attractive markets have the harvest objective in mind. An unattractive venture in an unattractive market makes an exit strategy very difficult. 4) Management team issues: It is both beneficial and important that a venture consists of an entrepreneurial team with proven experience within the chosen industry. Moreover, a team that possesses a complimentary and compatible skills base contributes to the attractiveness of the venture. 5) Fatal flaw issues: The presence of one or more fatal flaws renders the opportunity of a venture unattractive. Fatal flaws can be caused by: • Markets those are too small • Markets with overwhelming competitors • Markets where the cost of entry is too high • Markets where entrants are unable to produce a sustainable competitive advantage • Others include; the lack of an entrepreneurial team, lack of honesty and integrity. 6) Personal criteria: Successful entrepreneurs have a good fit between what they wish to derive from the venture and what the venture requires from them in order to do so. A successful entrepreneur takes calculated risks and has relatively high stress tolerance levels. An attractive opportunity is both desirable and good for the entrepreneur to pursue. 7) Strategic differentiation: Strategic differentiation refers to how a venture positions itself to take advantage of the given market conditions to its benefit, whilst maintaining its own identity, thus differentiating itself from the competitors in terms of the value added to customers. A high-potential venture tends to have an entrepreneurial team of high calibre with excellent service management. The venture management team is usually very flexible and can make decisions on its feet, as well as de-commit equally fast, should it need to. The pursuit of Opportunities The reasons for smaller entrepreneurs to take on the larger players successfully are numerous but can be attributed to: •Organisational inertia: this occurs when an organisation refuses to adapt in a responsive manner to changes that occur in the market place. •Organisational complacence: Established organisations tend to remain in a comfort zone and thus rely on current and past successes with the view to continue building on current strengths. This means that established organisations rarely pursue new ideas. •Bureaucracy: As businesses grow and become more successful, the levels in the hierarchy also expand due to increased financial, operational and human resource requirements. Over time communication becomes cumbersome and slow resulting in organisations becoming bureaucratic. Why organisations leave gaps in the market The most common reasons for bigger or more established businesses to leave gaps in the market are as follows: • Failure to see new opportunities • Underestimation of new opportunities • Technological inertia • Cultural inertia • Politics and internal fighting • Government support of new small entrants The Window of Opportunity The window of opportunity refers to the time period available for creating a new venture. As a market grows, more and more opportunities are revealed, and so the window of opportunity opens. As the market matures, the window of opportunity begins to close and the available opportunities in the market become fewer and fewer until they eventually peter out. Figuratively the market and its competitive environment can be viewed as being a ‘wall' (impenetrable). But where gaps have been left in these markets, are seen as ‘windows' and represent the opportunities in which current markets are not been serviced to its fullest potential. Once a window of opportunity has been identified, the window must remain open for long enough to enable an entrepreneur to take advantage of the opportunity. Seeing, Locating, Measuring, Opening and Closing the window of opportunity Opportunities do not always present themselves easily, nor do they last forever Seeing the window: identify gaps in the markets and possible opportunities Locating the window: fully understand how products or service offerings in the market compare with those of competitors. Measuring the window: Research and survey the market to ensure that the opportunity is feasible and viable Opening the window: entry into market and starting of the business Closing the window: the entrepreneur should try and create and maintain a sustainable competitive advantage STUDY UNIT 5 Chapter 5: The business plan Defining a Business Plan A business plan is a written document that carefully explains the business, its management team, its products or services and its goals (where the business is heading and explains how it is going to get there) A business plan therefore involves: • A process of planning: what goals entrepreneur wants to achieve • Strategies and actions plans for achieving the goals: how the entrepreneur will achieve them Reasons for drafting a Business Plan 1) To obtain funding: A business plan can be used to obtain financial resources by approaching investors, or applying for a loan at a financial institution. 2) To serve an internal purpose: A business plan can be used internally in the business to provide managers and staff with the following: Focus: Coordination of efforts towards a clearly defined objective Objective: Everyone will have a clear understanding of what they are working for. Measurement tool: A means of evaluating performance against expectations Marketing tool: A means to obtain funds and to communicate the business activities 3) To reduce business risk: By developing a business plan, the entrepreneur is forced to consider each aspect of the business and manage it accordingly. Quite often the formulation of the business plan reveals aspects that encourage the entrepreneur to consider alternatives and new directions, even a ‘plan B' in the event that certain assumptions are not realised. Standard format and layout of a Business Plan The following is an outline of a standard business plan: Cover Sheet: • Full name of the business • Ownership status • Full physical street address • Postal or official address for communication • Contact details: telephone, fax, e-mail and web-site information • Contact name and title • Date of the Business plan A Table of contents: Categorise the contents; List main headings and include sub-headings List all charts, tables and figures and list any appendixes or supporting documentation An Executive Summary: The summary briefly outlines the contents of the business plan. Generally is contains key points from each section of the plan in order to create an overview of the project. The summary must allow the reader to quickly obtain an overview of the business plan and to evaluate whether the contents would be of interest. A Product and/or services Plan: This section should briefly describe the product or service, the customer base, the current status of the industry and where the new business fits in. The following points must be included: •Description of the products and or service to be sold •Proprietary position •Potential A Marketing Plan: Attention must be paid in detail with reference to the 4 P's of Marketing: Product, Price, Place and Promotion. As well as • Customers: price, quality, service, personal contacts or political pressure. • Industry: Describe the size of the current total market, potential distributors and dealers. • Competition: Compare the competing products and services on price, performance, service, warranties. Do not make any guesses An Operational Plan: This section focuses on facilities, manufacturing capabilities and equipment. If the business is in manufacturing, it will help to include floor plans as well as future space plans. The following aspects must be mentioned: •Capacity: how many products can be produced by the business over a certain time period. •Scheduling of Production: refers to the timing and steps that will be taken to bring the business up to full speed. •Quality Management: This concerns what the business will do to ensure quality and control of inventory. A Management Plan: List all directors, consultants, advisers, and any other key professionals who will be involved in the business. Mention whether any of the Management team members have worked together in the past. Detailed CV's of the key Management should also be included. The Management plan therefore details the organisational structure of the business. A Financial Plan: The financial side of the business plan has to prove beyond all reasonable doubt that the business has the potential to be operated profitably. The financial section must clearly indicate the following: A. Establishment costs: ○ Product development costs (incl. R&D) ○ Legal costs (company registration, trademark, patients, advice, etc.) ○ Product testing costs (proto-type testing) ○ Market research costs ○ Cost of purchasing business premises (if not rented) ○ Cost of machinery and equipment ○ Cost of installing machinery and equipment ○ Office equipment and modifications ○Provision for operating costs (at least 6 months for factories and 3 months for retailers) & for unforeseen expenses ○ Current assets such as stock B. Break-even analysis: After the operating costs have been estimated for a specific period, the next step is to calculate the break-even point. The break-even point → gross profit = estimated operating costs. It is therefore important that: profit = the turnover required > turnover required to breakeven. C. Budgeted financial statements A pro forma cash flow statement: This should be done on a monthly basis for at least 2 years. A projected income statement: Based on the results of the marketing research, a provisional projected income statement should be compiled as per the example below: Projected Income Statement Calculation 1) Potential unit Sales 2) Average price per unit 3) Potential sales (turnover) (1) x (2) 4) Unit costs (manufacturing) 5) Cost of sales (1) x (4) 6) Gross profit (3) x (5) 7) Operating costs 8) Net profit before tax (6) x (7) A projected balance sheet: The projected balance sheet will include the following components: ASSETS Current assets Cash Inventory Account receivables Provision from income tax Fixed assets Land, Property and buildings Machinery and Equipment Vehicles Trademark Goodwill TOTAL ASSETS LIABILITIES AND EQUITY Current Liabilities Account payables Income tax Non-current liabilities Long term borrowings Equity Mr. X Dr. Y Miss. Z Retained earnings TOTAL LIABILITIES AND EQUITY D. Risks and problems: This includes: Potential price cutting by competitors Any unfavourable industry-wide trends Sales projections not achieved Product development schedule not met Difficulties in obtaining needed bank credit An Appendix: Includes all pieces of evidence - CV's, product brochures, customer listings, testimonials and news articles. How to select the most appropriate Business Plan Guidelines that assist the entrepreneur to select the most appropriate business plan in order to satisfy business requirements: • Understand how the new or existing business is going to operate • Understand the exact purpose of the specific business plan • Study and understand different types of business plans Types of Business Plans and their functions Different situations may require different types of business plans: • Planning a new business: In this case the business plan layout as above would be used • Transforming or expanding an existing business: Requires specific emphasis on the following; Why transformation is taking place Why expansion is taking place What the profit and growth implications could be What the costs could be How the transformation or expansion will be financed (loan capital / owners' equity (capital)) What the return on investment would be, compared with previous business actions or other options • Creating a strategic document for an existing or new business: Requires specific emphasis on the following; A vision and mission statement Clearly stated objectives for achieving the mission Competitive analysis Statement of competitive advantage Strategy for reaching objectives Action plan for implementing the strategy Controls to monitor performance Plan to implement corrective action, if necessary • Obtaining a loan: In this case the business plan layout should not differ from the business plan specifically designed for the strategic document above. However, with the conservative nature of financial institutions when evaluating loan application, specific points are required as follows; •Evidence of the customers' acceptance of the venture's product or service (market research) •An appreciation of the policy of banks with regard to risk and collateral •Evidence of focus and concentration on only a limited number of products and or services •Realistic financial projections •Realistic growth projections •Avoidance of infatuation with the product or service, rather than familiarity with real marketplace needs •Identification and consideration of potential risks •Avoidance of exaggeration of own and management's credentials and abilities Requirements of financial institutions: Does the proposed business venture have a good chance to develop into a successful business? o Will the product or service sell? o How committed are the targeted customers? o Does the business have a competent management team that works well together? o What security is available if things go wrong? o Has provision been made in the cash flow forecast for loan repayments? o What percentage of the start-up capital has the owner provided? o How realistic are the forecasts presented in the business plan? o Does the business plan address the perspective of creditors? • Attracting shareholders or partners: Need to prove that: Growth potential Profit potential Solid Management A complete strategy to achieve profit and growth projections Realistic projections based on market research • Selling the business: Fears of a prospective buyer: Reasons for selling Position of the business relative to competitors How competent are the staff and should they be retained? What is the credit rating of the business? Is the business profitable? What are the growth prospects of the business? What is the condition of the equipment and machinery? What is the current customer perception of the business? • Preparing the business for a merger: Under the conditions of a merger it is suggested that the reasons for seeking a partner to merge with should not be included in the business plan. The reasons should be predetermined and logically listed prior to negotiating a merger and therefore form part of the negotiations and not part of the business plan. The business plan should include the following: ○ A clear explanation of what exactly the business is all about and what its major activities entail ○ An independent evaluation of the business done by a professional valuator ○ Audited financial statements of past performance ○ A situational analysis (SWOT analysis) ○ A competitive analysis ○ An explanation of the competitive advantage(s) ○ An explanation of the future plans for the business Problems in drawing up a Business Plan • Lack of proven market demand • Lack of objectivity • Ignoring competition • Inappropriate market research • Inability to produce according to quantity and quality required • Underestimating financial requirements • Insufficient proof that loan repayments will be made timeously STUDY UNIT 6 Chapter 6: Resource requirements and legal and related aspects Resource requirements for a new business Financial Resources Financial resources may take the form of cash or cash equivalents or can be used to buy other resources. Finance can be obtained from various sources such as: • Equity financing: Money invested by the entrepreneur • Debt financing: Money loaned from individuals, banks or other lending institutions ↘The contract is legally binding stipulating that the borrower will pay interest ↘The loan needs to be paid back within a certain period of time as stipulated • Other sources of finance: Government support programmes: Kula Enterprise Finance Ltd, National Empowerment Corporation Venture capital funds: such as Community Projects Funds Companies: such as Business Partners, the Industrial Development Corporation of RSA (known as the IDC) Mortgages: for financing business property Long-term investments in operating assets: such as machinery Leasing: machinery, equipment and vehicle Human Resources Human resources refer to all the people who through their efforts, skills, knowledge and insight contribute to the success of the business. Human resources consist of four groups: ○ Top management ○ Middle management and Professional staff ○ Supervisory management ○ Non – Managerial workers A prospective entrepreneur is mainly concerned with the challenges of: 1. Accurately forecasting human resource needs, and 2. Recruiting candidates and selecting the best person for the job. The following steps can be taken by the entrepreneur to accurately forecast, recruit, select and appoint employees: List all the tasks that must be performed in the business Group tasks logically to form a job description to indicate the number of people to employ Determine what qualifications and skills the person must have Recruit people who are willing to do the tasks in the job description and who meet the job specifications by: Advertising the positions, Using recruitment agencies, Approach training organizations Interview candidates Appoint the best person for the job and conclude a contract with the person Physical Resources Physical resources include: Fixed assets, Raw materials, General supplies Planning is important in acquiring these resources, especially physical resources. A large amount of capital is required to acquire fixed assets, such as building facilities, production equipment and vehicles. Factors to consider when deciding on a suitable location: Access to the market Availability of raw materials Availability of labour and skills Infrastructure such as transport and water supply Climate Information Resources The technology or ‘Information Age' necessitates a fourth resource namely information. The Information is just as important as the other three and is needed so that the entrepreneur can make informed management decisions. The entrepreneur needs two categories of information: • Information about the external business environment International concerns Economic Social Legal concerns Competitors Customers • Information about the internal business environment Marketing information Human resources information Manufacturing Financial information Sources of Information Internet, Government departments (SARS, SABS, Stats SA, the Department of Trade and Industry, Chambers of commerce, Trade associations, Financial institutions) Legal requirements for establishing a business Forms of ownership To understand the different forms of ownership, the following concepts must be understood: • Legal personality: indicates whether or not the owner and the business are separate legal entities. If the business has legal personality, the owner and the business are two separate entities • Liability: indicates whether the owners of a business will be held personally liable for the business' debts. When liability is unlimited, owners' personal assets may be sold to cover the business' debts. With limited liability the owners are not held liable for the debts of the business • Continuity: refers to the lifespan of the business CRI TER IA SOLE PROPRIETO RSHIP PARTNERSHIP CLOSE CORPORATION PRIVATE COMPANY ME MB ERS 1 2 to 20 partners 1 – 10 members AT LEAST 1 DIRECTOR. 1 – 50 MEMBERS (SHAREHOLDERS) (1) LEG AL PER SO NA LIT Y (2) LIA BILI TY (1) NO (2) UNLIMITED LIABILITY – LIABLE FOR ALL RISKS, AND DEBTS OF THE ENTERPRISE IN HIS PERSONAL CAPACITY (1) NO. (2) JOINTLY AND SEVERLY LIABILITY – THE PARTNERS ARE JOINTLY LIABLE FOR ALL RISKS, AND DEBTS OF THE ENTERPRISE IN THEIR PERSONAL CAPACITIES. (1) YES. (2) LIMITED LIABILITY –IS A LEGAL PERSON, SEPARATE FROM ITS MEMBERS. THE MEMBERS ARE NOT PERSONALLY LIABLE FOR THE DEBTS OF THE ENTERPRISE. (1) YES. (2) LIMITED LIABILITY – LEGAL PERSON, SEPARATE FROM SHAREHOLDERS AND DIRECTORS. SHAREHOLDERS ARE NOT PERSONALLY LIABLE FOR THE DEBTS OF THE ENTERPRISE. LEG AL NA ME NONE NONE MUST END IN CC (PTY) LTD. PROPRIETORY LIMITED LIFE SPA N / CO NTI NUI TY LIMITED TO THE LIFE OF THE OWNER LIMITED TO THE LIFE OF THE PARTNERSHIP. THE DEATH OR WITHDRAWAL OF PARTNER DISSOLVES THE PARTNERSHIP, UNLESS OVERCOME BY AGREEMENT. UNLIMITED TO THE LIFE OF THE MEMBERS. UNLIMITED LIFESPAN . EAS E OF FO RM ATI ON SIMPLE EASY RELATIVE EASY HIGH DEGREE OF LEGAL REGULATION MAKING FORMATION COMPLICATED CA PIT AL AC QUI SITI ON CAP ACI TY LIMITED ACCESS TO CAPITAL. LOANS BASED ON PERSONAL CREDITWOR THINESS. ABILITY TO ACCESS CAPITAL. MORE PEOPLE CONTRIBUTE SECURITY TO LOANS BASED ON PERSONAL CREDITWORTHINESS . BETTER ABILITY TO ACCESS CAPITAL. MEMBERS CONTRIBUTE TOWARDS THE ENTERPRISE, LOAN CAPITAL EASIER TO OBTAIN. GOOD ABILITY TO ACCESS CAPITAL LOAN CAPITAL EASIER TO COME BY DUE TO LEGAL REGULATION OF COMPANIES AND DISCLOSURE. OW NE RSH IP AN D CO THE OWNER TAKES COMPLETE CONTROL OF THE ENTERPRISE PARTNERS HAVE JOINT CONTROL AND AUTHORITY OVER THE ENTERPRISE. MEMBERS HAVE JOINT CONTROL AND AUTHORITY OVER THE ENTERPRISE. ASSOSSIATION AGREEMENT CAN DEFINE ASPECTS OF.

Serial 1 3 1. Voorbeeld 4 van de 35 pagina's

In winkelwagengesponsord bericht van onze partner

- Niet goed, geld terug

- Document is direct beschikbaar

- Beter voorbereid op je tentamens

- 28

- 1

- Geupload op2 november 2021

- Aantal pagina's35

- Geschreven in2021/2022

- TypeSamenvatting

- InstellingUniversity of South Africa

- VakMNE2601 - Introduction To Entrepreneurship And Small Business Management (MNE2601)

- Geupload op2 november 2021

- Aantal pagina's35

- Geschreven in2021/2022

- TypeSamenvatting

- InstellingUniversity of South Africa

- VakMNE2601 - Introduction To Entrepreneurship And Small Business Management (MNE2601)

Window Switcher Windows 10

Voordelen van het kopen van samenvattingen bij Stuvia op een rij:

Verzekerd van kwaliteit door reviews

Stuvia-kopers hebben meer dan 450.000 samenvattingen beoordeeld. Zo weet je zeker dat je de beste documenten koopt!

Snel en makkelijk kopen

Contexts 2 4 – Fast Window Switcher System

Je betaalt supersnel en eenmalig met iDeal, creditcard of Stuvia-tegoed voor de samenvatting. Zonder lidmaatschap.

Focus op de essentie

Sound Switcher Windows 10

Samenvattingen worden geschreven voor en door anderen. Daarom zijn de samenvattingen altijd betrouwbaar en actueel. Zo kom je snel tot de kern!